You can manage garnishments with ease, reducing the chance of errors and making certain staff’ obligations are met precisely and efficiently. In this task, when you entered pay history, you’ll enter federal and state tax filing details for closed quarters. Enter quickbooks payroll enhanced correct tax information for each worker, including federal, state, and native withholdings. This step ensures that tax calculations are accurate, stopping issues for both you and your employees.

How Am I Able To Arrange Direct Deposit In The Quickbooks Desktop?

Maintain me posted in case you have different issues about the payroll subscription. I have 3 firms that I utilize payroll beneath the identical subscription, and I don’t need an enormous $1,500 per 12 months payment for all three corporations underneath the one firm. Click here to see a cumulative list of all e-file & pay updates for 2025. Find help articles, video tutorials, and join with other businesses in our online community. QuickBooks On-line Payroll works for small to midsize businesses—from accountants and financial experts to hospitality firms, building companies, and truckers. If you haven’t paid employees but this 12 months, you won’t need to finish this step.

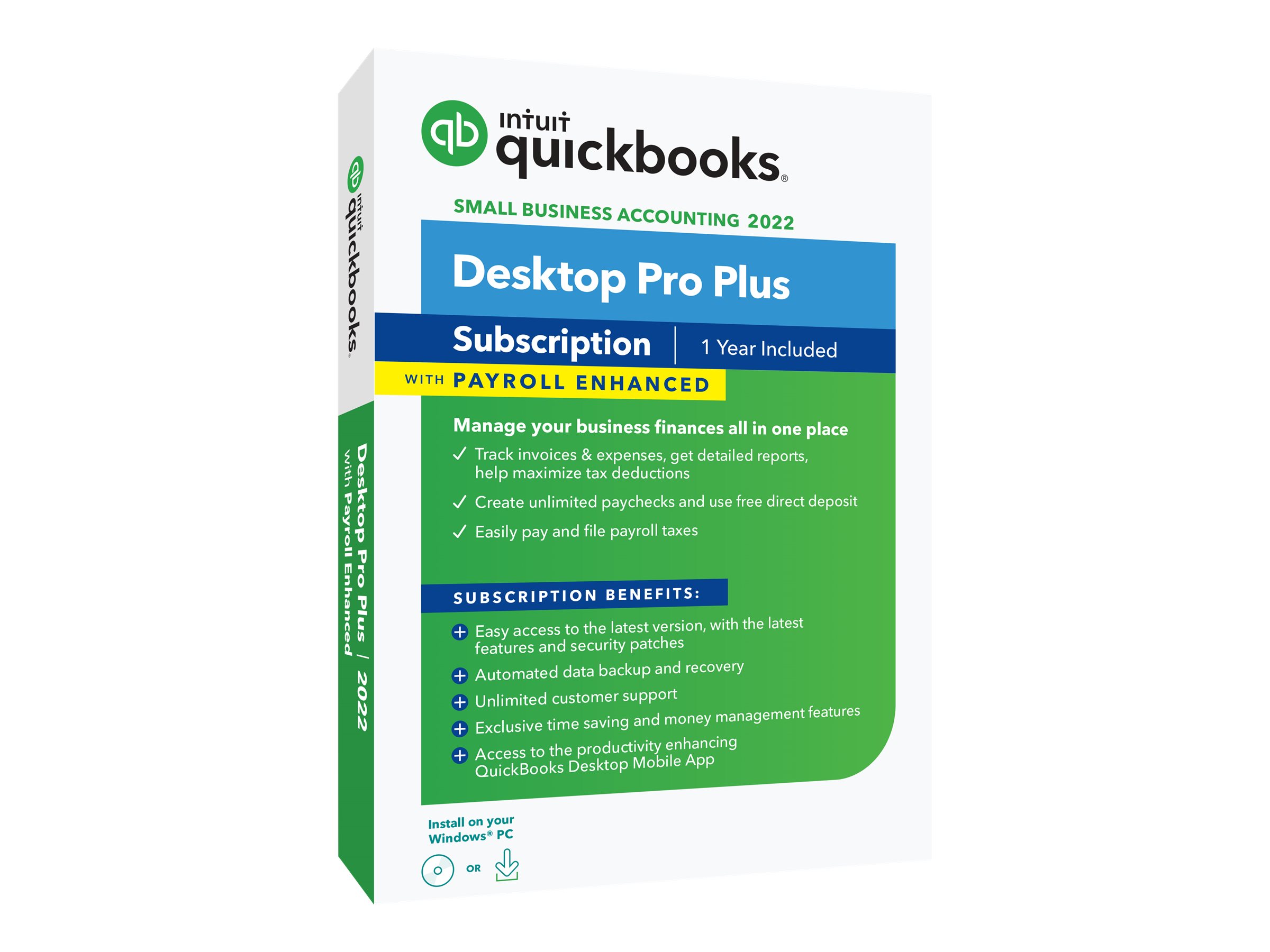

QuickBooks Desktop Enhanced Payroll simplifies payroll taxes by routinely calculating federal and state payroll taxes primarily based on present rates. Once reviewed, merely click ‘Submit’ and QuickBooks takes care of the remainder, including tax calculations and direct deposits. You May find payroll processing much less tense and more like hitting a house run in your first attempt. QuickBooks Enterprise provides a complicated answer beyond important payroll administration for rising companies and bigger companies.

This automated system ensures that your tax submitting is at all times correct and timely, reducing the chance of penalties because of missed or incorrect filings. Whether Or Not you’re using QuickBooks Enterprise or another version of QuickBooks, this step is seamless. QuickBooks Desktop is ideal for these who need direct, hands-on management of their payroll. By subscribing to the payroll service, you’ll get computerized tax table updates, making tax submitting simple and environment friendly.

Firm Info

Whether you are dealing with salaried employees or hourly contractors, it presents versatile choices to make sure everybody will get paid accurately and on time. With all these capabilities, it’s no surprise many businesses are adopting QuickBooks for payroll administration. In conclusion, Enhanced Payroll in QuickBooks is a complete answer that simplifies payroll processes for companies, providing automation, accuracy, and compliance. Compliance administration is a critical facet of payroll, and QuickBooks Payroll excels on this area. With automated compliance updates and alerts, you possibly can ensure your payroll processes adhere to the newest rules.

You can concentrate on rising your corporation whereas QuickBooks handles the complicated tax submitting process, providing peace of mind and making certain compliance with tax rules. To begin working payroll via the improved payroll on the desktop product, you will want an active payroll subscription. QuickBooks offers a 30-day trial for free of charge, allowing you to explore its options and get conversant in the system earlier than making a dedication.

Integrating time monitoring with QuickBooks Payroll is a seamless experience that enhances payroll accuracy. I loved how this feature automatically syncs worker hours with payroll, decreasing the danger of errors and making certain staff are paid precisely for their time labored. You can streamline your payroll process and eliminate guide data entry, saving you time and enhancing https://www.quickbooks-payroll.org/ total effectivity. QuickBooks Payroll simplifies payroll management with its intuitive interface and complete options. It automates tax calculations and filings, making certain accuracy and compliance, making it a priceless software for businesses of all sizes. Companies should evaluate their unique requirements when selecting between QuickBooks Desktop Enhanced Payroll and QuickBooks On-line Payroll.

Faqs About Quickbooks Enhanced Vs Assisted Payroll:

- Setting up Enhanced Payroll is like setting the foundation of a house; get it proper, and every little thing else turns into easier.

- If you’re someone who likes to control compliance, the choice to file and pay taxes electronically is another function that you simply’re sure to understand.

- From uploading and sharing documents to requesting e-signature and automating l-9 compliance, do all of it from one easy-to-use platform.

- In case you want to enhance enterprise effectivity and you don’t have a good price range then you can get entry to QuickBooks Enterprise Diamond.

- With Enhanced Payroll on Quickbooks Desktop, you’ll be able to handle everything from payroll taxes and tax filing to worker funds in just a few clicks.

- Overlook about issuing paper checks; you can pay workers immediately via electronic switch.

If you utilize QuickBooks Desktop Payroll Enhanced, you might also set up to pay your payroll taxes electronically. Examine the pricing plans and weigh them towards the features you will use most. Are you a small business with a handful of staff, or a larger entity with complex payroll needs? The flexibility of Enhanced Payroll ensures there’s one thing for everyone. Frequent points might embrace error messages throughout payroll processing or points with syncing knowledge.

Assisted has the added benefit of being each comprehensive and totally built-in with QuickBooks – easily beating any competition on that front. It works with as much as 250 employees and handles multi-state, should that be a need. Embody T-Sheets (online time tracking), and you have got a well-oiled payroll machine with much less information entry and better accuracy. After you’ve got enrolled, it’s time to discover the configuration settings. QuickBooks will guide you thru varied options, allowing you to tailor the platform to your small business wants. Whether it’s defining pay durations or deciding on payroll taxes, this setup part is essential for smooth sailing down the road.

The firm file is the core of your payroll system, storing important employee details such as wage data, tax deductions, advantages, and more. Ensuring all fields are filled out precisely will prevent errors whenever you eventually run payroll. Make certain to enter particulars like employee names, addresses, social security numbers, and withholding allowances carefully. Accuracy at this stage helps you keep away from frequent errors and ensures your payroll process is smooth. QuickBooks Payroll provides a number of pricing plans to accommodate different business wants.